(In college Stephen switched majors from Accounting to Computer Programming)

(In college Stephen switched majors from Accounting to Computer Programming)

The first thing you need to create a budget is information. Start by gathering a year of bank statements, credit card statements, ledgers, receipts or other transaction reports. You may be able to go to your online banking and pull transaction reports. You will use these to calculate incoming and outgoing money, get averages, maximums, and trends.

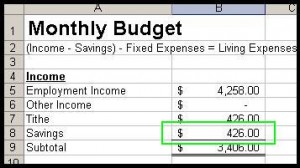

Next you need to create yourself a digital spreadsheet using Excel, Open Office, or Google Docs. Here is an Excel Budget Template that I made up for you. After you have the transactions, divide all of them into categories and enter them into the spreadsheet. If you have digital reports from your online banking, then you may be able to do some copying and pasting to save time. I suggest you use these categories, but use what works for you.

- Employment Income – your primary job or source of income

- Other Income – rental income, child support, side work, etc

- Bonuses, Gifts & Tax Returns – the random money that comes in. I always get money back on my taxes, because I choose to deduct more than I need to.

- Tithes – if you are active in a church, you should be giving 10% of your income before you use it

- Savings – a good starting goal is to save 10% of your income (later you want to increase this to 25% or more)

- Mortgage – your mortgage payment (may include escrow taxes & insurance)

- Utilities – Gas, Water, Sewer, Electric, and Sanitation

- Car Loans – car loan payments

- Car Insurance – the cost to insure your daily transportation

- Other insurances – life insurance, boat insurance, etc.

- Student Loans – college loan payments

- Medical Expenses – health insurance, medications, doctor visits, and hospital bills.

- Television – Net Flix, Satellite Service, Cable TV etc.

- Cell Phone – this one is straight forward

- Internet – the cost to have internet service to your home

- Gasoline – the cost to fill you vehicles with gas

- Groceries – what you spend at the grocery store and at general stores like Wal-Mart or Walgreens

- Health & Beauty – massage, chiropractic work (if not medical), hair cuts and styles, nails, etc.

- Home Maintenance & Repair – gardening expenses, maid services, appliance repair and replacement

- Travel – park tickets, air fair, hotel costs, dinning costs, and other expenses related to vacation trips

- Auto Maintenance/Repair – oil changes, tire replacement, engine repairs

- Gifts – what you spend on family, spouses, and friends

- Shopping – clothes, books, music, toys, and hobbies

- Credit Card Interest – not what your min credit card payment is, but what your interest charge is

- Entertainment – concerts, cigarettes, alcohol, video games, etc.

- Eating Out – fast food, coffee shops, sit down restaurants, convenience stores, ice cream parlors, etc.

- Donations – other charities you give to

Filling Out the Budget

After you have all of the transactions recorded, divide the total of each category by 12 to get a monthly average for that category. Then put those averages into the budget template I provided you. This will give you an idea of your current habits. Once you know what you spend, you will know where you can cut/curb your spending.

Next below your monthly income in box B8 enter the amount of money you are going to put towards savings or debt repayment. I suggest 10% of your income to start with. In the long run, your goal should be to increase your savings to 25% or more.

Next below your monthly income in box B8 enter the amount of money you are going to put towards savings or debt repayment. I suggest 10% of your income to start with. In the long run, your goal should be to increase your savings to 25% or more.

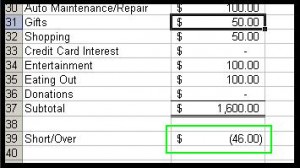

Now, at the bottom of the Budget Template in box B39 you will see how much more or less you need to spend each month in living expenses. Go through and adjust the living expense line items until box B39 equals zero. When creating your budget, I suggest making small adjustments, so you can be successful. Making to big of changes all at once will be difficult and may cause you to give up all together. On the other hand small successes will give you encouragement to keep up the good work.

Now, at the bottom of the Budget Template in box B39 you will see how much more or less you need to spend each month in living expenses. Go through and adjust the living expense line items until box B39 equals zero. When creating your budget, I suggest making small adjustments, so you can be successful. Making to big of changes all at once will be difficult and may cause you to give up all together. On the other hand small successes will give you encouragement to keep up the good work.

The end result is a monthly budget template. You can now use this template when doing your monthly budget. Your monthly budget will change based on upcoming events each month. Things like birthdays, taxes, Christmas, will all affect your budget.

Notice that I did not include the “Bonuses, Gifts & Tax Returns” category on the budget template. Since those things vary too much and are unpredictable, you should not count on them. What I do when I do get them is I put them straight into savings or towards a debt.

Your budget template shows you what your spending goals are. Track what you spend, either on a daily or weekly basis. Keep your receipts and make a chart on paper or on a computerized spreadsheet, or use tools like Mint.com. Sometimes you won’t spend all of your allotted money for a category, and sometimes you will spend more. The hope is that your short and over cancel each other out and you meet your goal.

You should notice that in many months you won’t spend any money towards home, auto, or travel. Make sure that you still put money aside for those things, so that the months that you need to replace all the tires on your truck, you have the money set aside already. You also want to have the money available to for that unforeseen funeral, or the planned trip to Disney Land. Set goals and look ahead to predict these expenses, so they don’t surprise you.

In order to increase your savings and living expenses budget, you need to increase your income. Look for work opportunities like baby sitting, article writing, passive income, craft sales, yard work or janitorial services. Look for ways to use your unique skills or talents to make some extra money. Ask for overtime. Do your best at work, to get that promotion. You can also invest in things like rental properties, vending machines, ATM’s, tax leans, or dividend paying stocks.

Also, look into reducing your fixed expenses. Do what you can to reduce your utility usage. Turn off lights and TV’s when not in use, fix leaky faucets and toilettes, and turn down the heat. Replace your current toilettes with a 1.28 gal high efficiency toilette. I suggest the American Standard Cadet 3, I’ve had wonderful success with it. Try calling your student loan administrator to see if there is a longer term repayment plan. Use some of your living expenses to pay off high interest credit cards, and then focus on the highest interest loans. Always pay off the highest interest debts first. Look for a cheaper internet and television provider, or negotiate with your current one. See if you can go with out a cell phone. Maybe you can go without a television service, since you use Netflix, or Hulu Plus. See if you can refinance your home to get a lower interest rate. See is you can downgrade your home for something that cost less. See if you can trade in your car for something that cost less.

Tips for Sticking to Your Budget

Making the most of your spending money will help you stick to your budget. Grocery stores put the same things on sale about every two months. If you can get in the habit of buying only what is on sale and having a two months supply, then you will save money. You can also find and use coupons to help you cut your costs. Learn to eat cheaper; things like fresh berries can have a high cost per calorie count. Try eating them less and try eating whole grains, brown rice, potatoes and other low cost, high calorie foods. Also, cooking meals from scratch will save you money over prepackaged foods, or going out to eat. Maybe you can learn to cut and dye your own hair, to save yourself some money. Learning to do much of your own home and auto repairs will also save you money. Look for cheaper forms of entertainment. Instead of going to watch the big game live, watch it on TV instead. Watch a movie at home, instead of at the theater. There are many examples of cheaper substitutes, look for them.

Remember that your budget is not going to be a set in stone thing. It needs to be fluid. Life happens, and you may find yourself stressing out, or spending too much time adjusting your budget. If you find yourself doing that, or you are having a hard time keeping track of each category, try reducing the number of categories by combining them into broader groups. Groups like; needs, wants, income and savings. This will help you get a hold of the big picture and not stress on the details.

Conclusion

Budgeting is all about tracking your spending, using will power to make the most of your money today and finding the balance between living for today and living for tomorrow. I know you can do it, and I wish you luck. Please feel free to contact me if you have any questions.

What about you? Is there anything that you do, that has helped you be successful with budgeting?